An Important, Long Article

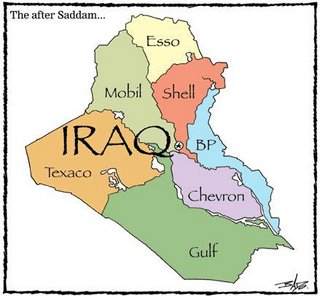

The 'IoS' today reveals a draft for a new law that would give Western oil companies a massive share in the third largest reserves in the world. To the victors, the oil? That is how some experts view this unprecedented arrangement with a major Middle East oil producer that guarantees investors huge profits for the next 30 years

"So was this what the Iraq war was fought for, after all? As the number of US soldiers killed since the invasion rises past the 3,000 mark, and President George Bush gambles on sending in up to 30,000 more troops, The Independent on Sunday has learnt that the Iraqi government is about to push through a law giving Western oil companies the right to exploit the country's massive oil reserves.

And Iraq's oil reserves, the third largest in the world, with an estimated 115 billion barrels waiting to be extracted, are a prize worth having. As Vice-President Dick Cheney noted in 1999, when he was still running Halliburton, an oil services company, the Middle East is the key to preventing the world running out of oil.

Now, unnoticed by most amid the furore over civil war in Iraq and the hanging of Saddam Hussein, the new oil law has quietly been going through several drafts, and is now on the point of being presented to the cabinet and then the parliament in Baghdad. Its provisions are a radical departure from the norm for developing countries: under a system known as "production-sharing agreements", or PSAs, oil majors such as BP and Shell in Britain, and Exxon and Chevron in the US, would be able to sign deals of up to 30 years to extract Iraq's oil.

PSAs allow a country to retain legal ownership of its oil, but gives a share of profits to the international companies that invest in infrastructure and operation of the wells, pipelines and refineries. Their introduction would be a first for a major Middle Eastern oil producer. Saudi Arabia and Iran, the world's number one and two oil exporters, both tightly control their industries through state-owned companies with no appreciable foreign collaboration, as do most members of the Organisation of Petroleum Exporting Countries, Opec.

Critics fear that given Iraq's weak bargaining position, it could get locked in now to deals on bad terms for decades to come. "Iraq would end up with the worst possible outcome," said Greg Muttitt of Platform, a human rights and environmental group that monitors the oil industry. He said the new legislation was drafted with the assistance of BearingPoint, an American consultancy firm hired by the US government, which had a representative working in the American embassy in Baghdad for several months.

"Three outside groups have had far more opportunity to scrutinise this legislation than most Iraqis," said Mr Muttitt. "The draft went to the US government and major oil companies in July, and to the International Monetary Fund in September. Last month I met a group of 20 Iraqi MPs in Jordan, and I asked them how many had seen the legislation. Only one had."

Britain and the US have always hotly denied that the war was fought for oil. On 18 March 2003, with the invasion imminent, Tony Blair proposed the House of Commons motion to back the war. "The oil revenues, which people falsely claim that we want to seize, should be put in a trust fund for the Iraqi people administered through the UN," he said.

"The United Kingdom should seek a new Security Council Resolution that would affirm... the use of all oil revenues for the benefit of the Iraqi people."

That suggestion came to nothing. In May 2003, just after President Bush declared major combat operations at an end, under a banner boasting "Mission Accomplished", Britain co-sponsored a resolution in the Security Council which gave the US and UK control over Iraq's oil revenues. Far from "all oil revenues" being used for the Iraqi people, Resolution 1483 continued to make deductions from Iraq's oil earnings to pay compensation for the invasion of Kuwait in 1990.

That exception aside, however, the often-stated aim of the US and Britain was that Iraq's oil money would be used to pay for reconstruction. In July 2003, for example, Colin Powell, then Secretary of State, insisted: "We have not taken one drop of Iraqi oil for US purposes, or for coalition purposes. Quite the contrary... It cost a great deal of money to prosecute this war. But the oil of the Iraqi people belongs to the Iraqi people; it is their wealth, it will be used for their benefit. So we did not do it for oil."

Paul Wolfowitz, Deputy Defense Secretary at the time of the war and now head of the World Bank, told Congress: "We're dealing with a country that can really finance its own reconstruction, and relatively soon."

But this optimism has proved unjustified. Since the invasion, Iraqi oil production has dropped off dramatically. The country is now producing about two million barrels per day. That is down from a pre-war peak of 3.5 million barrels. Not only is Iraq's whole oil infrastructure creaking under the effects of years of sanctions, insurgents have constantly attacked pipelines, so that the only steady flow of exports is through the Shia-dominated south of the country.

Worsening sectarian violence and gangsterism have driven most of the educated élite out of the country for safety, depriving the oil industry of the Iraqi experts and administrators it desperately needs.

And even the present stunted operation is rife with corruption and smuggling. The Oil Ministry's inspector-general recently reported that a tanker driver who paid $500 in bribes to police patrols to take oil over the western or northern border would still make a profit on the shipment of $8,400.

"In the present state, it would be crazy to pump in more money, just to be stolen," said Greg Muttitt. "It's another reason not to bring in $20bn of foreign money now."

Before the war, Mr Bush endorsed claims that Iraq's oil would pay for reconstruction. But the shortage of revenues afterwards has silenced him on this point. More recently he has argued that oil should be used as a means to unify the country, "so the people have faith in central government", as he put it last summer.

But in a country more dependent than almost any other on oil - it accounts for 70 per cent of the economy - control of the assets has proved a recipe for endless wrangling. Most of the oil reserves are in areas controlled by the Kurds and Shias, heightening the fears of the Sunnis that their loss of power with the fall of Saddam is about to be compounded by economic deprivation.

The Kurds in particular have been eager to press ahead, and even signed some small PSA deals on their own last year, setting off a struggle with Baghdad. These issues now appear to have been resolved, however: a revenue-sharing agreement based on population was reached some months ago, and sources have told the IoS that regional oil companies will be set up to handle the PSA deals envisaged by the new law.

The Independent on Sunday has obtained a copy of an early draft which was circulated to oil companies in July. It is understood there have been no significant changes made in the final draft. The terms outlined to govern future PSAs are generous: according to the draft, they could be fixed for at least 30 years. The revelation will raise Iraqi fears that oil companies will be able to exploit its weak state by securing favourable terms that cannot be changed in future.

Iraq's sovereign right to manage its own natural resources could also be threatened by the provision in the draft that any disputes with a foreign company must ultimately be settled by international, rather than Iraqi, arbitration.

In the July draft obtained by The Independent on Sunday, legislators recognise the controversy over this, annotating the relevant paragraph with the note, "Some countries do not accept arbitration between a commercial enterprise and themselves on the basis of sovereignty of the state."

It is not clear whether this clause has been retained in the final draft.

Under the chapter entitled "Fiscal Regime", the draft spells out that foreign companies have no restrictions on taking their profits out of the country, and are not subject to any tax when doing this.

"A Foreign Person may repatriate its exports proceeds [in accordance with the foreign exchange regulations in force at the time]." Shares in oil projects can also be sold to other foreign companies: "It may freely transfer shares pertaining to any non-Iraqi partners." [HERE IS WHERE ISRAEL WILL OWN IRAQI OIL] The final draft outlines general terms for production sharing agreements, including a standard 12.5 per cent royalty tax for companies.

It is also understood that once companies have recouped their costs from developing the oil field, they are allowed to keep 20 per cent of the profits, with the rest going to the government. According to analysts and oil company executives, this is because Iraq is so dangerous, but Dr Muhammad-Ali Zainy, a senior economist at the Centre for Global Energy Studies, said: "Twenty per cent of the profits in a production sharing agreement, once all the costs have been recouped, is a large amount." In more stable countries, 10 per cent would be the norm.

While the costs are being recovered, companies will be able to recoup 60 to 70 per cent of revenue; 40 per cent is more usual. David Horgan, managing director of Petrel Resources, an Aim-listed oil company focused on Iraq, said: "They are reasonable rates of return, and take account of the bad security situation in Iraq. The government needs people, technology and capital to develop its oil reserves. It has got to come up with terms which are good enough to attract companies. The major companies tend to be conservative."

Dr Zainy, an Iraqi who has recently visited the country, said: "It's very dangerous ... although the security situation is far better in the north." Even taking that into account, however, he believed that "for a company to take 20 per cent of the profits in a production sharing agreement once all the costs have been recouped is large".

He pointed to the example of Total, which agreed terms with Saddam Hussein before the second Iraq war to develop a huge field. Although the contract was never signed, the French company would only have kept 10 per cent of the profits once the company had recovered its costs.

And while the company was recovering its costs, it is understood it agreed to take only 40 per cent of the profits, the Iraqi government receiving the rest.

Production sharing agreements of more than 30 years are unusual, and more commonly used for challenging regions like the Amazon where it can take up to a decade to start production. Iraq, in contrast, is one of the cheapest and easiest places in the world to drill for and produce oil. Many fields have already been discovered, and are waiting to be developed.

Analysts estimate that despite the size of Iraq's reserves - the third largest in the world - only 2,300 wells have been drilled in total, fewer than in the North Sea.

Confirmation of the generous terms - widely feared by international non government organisations and Iraqis alike - have prompted some to draw parallels with the production-sharing agreements Russia signed in the 1990s, when it was bankrupt and in chaos.

At the time Shell was able to sign very favourable terms to develop oil and gas reserves off the coast of Sakhalin island in the far east of Russia. But at the end of last year, after months of thinly veiled threats from the environment regulator, the Anglo-Dutch company was forced to give Russian state-owned gas giant Gazprom a share in the project.

Although most other oil experts endorsed the view that PSAs would be needed to kick-start exports from Iraq, Mr Muttitt disagreed. "The most commonly mentioned target has been for Iraq to increase production to 6 million barrels a day by 2015 or so," he said. "Iraq has estimated that it would need $20bn to $25bn of investment over the next five or six years, roughly $4bn to $5bn a year. But even last year, according to reports, the Oil Ministry had between $3bn and $4bn it couldn't invest. The shortfall is around $1bn a year, and that could easily be made up if the security situation improved.

"PSAs have a cost in sovereignty and future revenues. It is not true at all that this is the only way to do it." Technical services agreements, of the type common in countries which have a state-run oil corporation, would be all that was necessary.

James Paul of Global Policy Forum, another advocacy group, said: "The US and the UK have been pressing hard on this. It's pretty clear that this is one of their main goals in Iraq." The Iraqi authorities, he said, were "a government under occupation, and it is highly influenced by that. The US has a lot of leverage... Iraq is in no condition right now to go ahead and do this."

Mr Paul added: "It is relatively easy to get the oil in Iraq. It is nowhere near as complicated as the North Sea. There are super giant fields that are completely mapped, [and] there is absolutely no exploration cost and no risk. So the argument that these agreements are needed to hedge risk is specious."

One point on which all agree, however, is that only small, maverick oil companies are likely to risk any activity in Iraq in the foreseeable future. "Production over the next year in Iraq is probably going to fall rather than go up," said Kevin Norrish, an oil analyst from Barclays. "The whole thing is held together by a shoestring; it's desperate."

An oil industry executive agreed, saying: "All the majors will be in Iraq, but they won't start work for years. Even Lukoil [of Russia], the Chinese and Total [of France] are not in a rush to endanger themselves. It's now very hard for US and allied companies because of the disastrous war."

Mr Muttitt echoed warnings that unfavourable deals done now could unravel a few years down the line, just when Iraq might become peaceful enough for development of its oil resources to become attractive. The seeds could be sown for a future struggle over natural resources which has led to decades of suspicion of Western motives in countries such as Iran.

Iraqi trade union leaders who met recently in Jordan suggested that the legislation would cause uproar once its terms became known among ordinary Iraqis.

"The Iraqi people refuse to allow the future of their oil to be decided behind closed doors," their statement said. "The occupier seeks and wishes to secure... energy resources at a time when the Iraqi people are seeking to determine their own future, while still under conditions of occupation."

The resentment implied in their words is ominous, and not only for oil company executives in London or Houston. The perception that Iraq's wealth is being carved up among foreigners can only add further fuel to the flames of the insurgency, defeating the purpose of sending more American troops to a country already described in a US intelligence report as a cause célèbre for terrorism.

America protects its fuel supplies - and contracts

Despite US and British denials that oil was a war aim, American troops were detailed to secure oil facilities as they fought their way to Baghdad in 2003. And while former defence secretary Donald Rumsfeld shrugged off the orgy of looting after the fall of Saddam's statue in Baghdad, the Oil Ministry - alone of all the seats of power in the Iraqi capital - was under American guard.

Halliburton, the firm that Dick Cheney used to run, was among US-based multinationals that won most of the reconstruction deals - one of its workers is pictured, tackling an oil fire. British firms won some contracts, mainly in security. But constant violence has crippled rebuilding operations. Bechtel, another US giant, has pulled out, saying it could not make a profit on work in Iraq.

In just 40 pages, Iraq is locked into sharing its oil with foreign investors for the next 30 years

A 40-page document leaked to the 'IoS' sets out the legal framework for the Iraqi government to sign production- sharing agreement contracts with foreign companies to develop its vast oil reserves.

The paper lays the groundwork for profit-sharing partnerships between the Iraqi government and international oil companies. It also lays out the basis for co-operation between Iraq's federal government and its regional authorities to develop oil fields.

The document adds that oil companies will enjoy contracts to extract Iraqi oil for up to 30 years, and stresses that Iraq needs foreign investment for the "quick and substantial funding of reconstruction and modernisation projects".

It concludes that the proposed hydrocarbon law is of "great importance to the whole nation as well as to all investors in the sector" and that the proceeds from foreign investment in Iraq's oilfields would, in the long term, decrease dependence on oil and gas revenues.

The role of oil in Iraq's fortunes

Iraq has 115 billion barrels of known oil reserves - 10 per cent of the world total. There are 71 discovered oilfields, of which only 24 have been developed. Oil accounts for 70 per cent of Iraq's GDP and 95 per cent of government revenue. Iraq's oil would be recovered under a production sharing agreement (PSA) with the private sector. These are used in only 12 per cent of world oil reserves and apply in none of the other major Middle Eastern oil-producing countries. In some countries such as Russia, where they were signed at a time of political upheaval, politicians are now regretting them.

The $50bn bonanza for US companies piecing a broken Iraq together

The task of rebuilding a shattered Iraq has gone mainly to US companies.

As well as contractors to restore the infrastructure, such as its water, electricity and gas networks, a huge number of companies have found lucrative work supporting the ongoing coalition military presence in the country. Other companies have won contracts to restore Iraq's media; its schools and hospitals; its financial services industry; and, of course, its oil industry.

In May 2003, the Coalition Provisional Authority (CPA), part of the US Department of Defence, created the Project Management Office in Baghdad to oversee Iraq's reconstruction.

In June 2004 the CPA was dissolved and the Iraqi interim government took power. But the US maintained its grip on allocating contracts to private companies. The management of reconstruction projects was transferred to the Iraq Reconstruction and Management Office, a division of the US Department of State, and the Project and Contracting Office, in the Department of Defence.

The largest beneficiary of reconstruction work in Iraq has been KBR (Kellogg, Brown & Root), a division of US giant Halliburton, which to date has secured contracts in Iraq worth $13bn (£7bn), including an uncontested $7bn contract to rebuild Iraq's oil infrastructure. Other companies benefiting from Iraq contracts include Bechtel, the giant US conglomerate, BearingPoint, the consultant group that advised on the drawing up of Iraq's new oil legislation, and General Electric. According to the US-based Centre for Public Integrity, 150-plus US companies have won contracts in Iraq worth over $50bn.

30,000 Number of Kellogg, Brown and Root employees in Iraq.

36 The number of interrogators employed by Caci, a US company, that have worked in the Abu Ghraib prison since August 2003.

$12.1bn UN's estimate of the cost of rebuilding Iraq's electricity network.

$2 trillion Estimated cost of the Iraq war to the US, according to the Nobel prize-winning economist Joseph Stiglitz.

WHAT THEY SAID

"Oil revenues, which people falsely claim that we want to seize, should be put in a trust fund for the Iraqi people"

Tony Blair; Moving motion for war with Iraq, 18 March 2003

"Oil belongs to the Iraqi people; the government has... to be good stewards of that valuable asset "

George Bush; Press conference, 14 June 2006

"The oil of the Iraqi people... is their wealth. We did not [invade Iraq] for oil "

Colin Powell; Press briefing, 10 July 2003

"Oil revenues of Iraq could bring between $50bn and $100bn in two or three years... [Iraq] can finance its reconstruction"

Paul Wolfowitz; Deputy Defense Secretary, March 2003

"By 2010 we will need [a further] 50 million barrels a day. The Middle East, with two-thirds of the oil and the lowest cost, is still where the prize lies"

Dick Cheney; US Vice-President, 1999 "

No comments:

Post a Comment